2022 UPDATE: If your wells are shut in due to offset fracs, here’s a perfect video for you!

by Tracy Lenz, PE, CMA.

by Tracy Lenz, PE, CMA.

Tracy is a licensed professional engineer (BS & MS in Petroleum Engineering) with over 15 years in the industry working for oil & gas operators. She left that world to assist mineral owners with navigating mineral value, royalty questions, and general help. Ask her your questions at tracy@pecantreeog.com

It’s not hard to find a headline referencing “shutting in wells” or “shut-in production” due to COVID-19 commodity pricing or storage at capacity. But what does that actually mean? Is it as easy as flipping a switch? And how does shutting in a well affect the long-term production potential?

Production 101

Above: Production “Christmas tree” for a naturally flowing well.

To shut in a well means to make it not produce, so we’ll start with a primer on production. When a well is “producing” it means the well has been drilled, completed in a reservoir, and oil and/or gas is somehow moving up the wellbore and to the surface facility. A well that is “shut-in” has some mechanism in place that keeps the hydrocarbons from flowing up the well.

The stereotypical producing “oil well” has a pumping unit (the horse-looking thing that goes up and down) and a stereotypical gas well has a “Christmas tree” (yes, it’s actually called that), however there is a wide variety of ways a well can produce. The primary controlling factor is pressure in the reservoir.

HIGH/ORIGINAL PRESSURE

When a well is first drilled or an reservoir first discovered, there is typically enough pressure in the reservoir to push the hydrocarbons up to the surface. If you imagine the reservoir as a tube of toothpaste that’s under a heavy rock, toothpaste would come shooting out if you were to poke a hole with a pointy straw.

Typically “normally pressured” reservoirs have ~0.44 psi of pressure for every foot of depth underground (which means 100 feet below ground has about as much pressure as a standard inflated car tire).

UNCONVENTIONAL HORIZONTAL FRACTURED WELLS

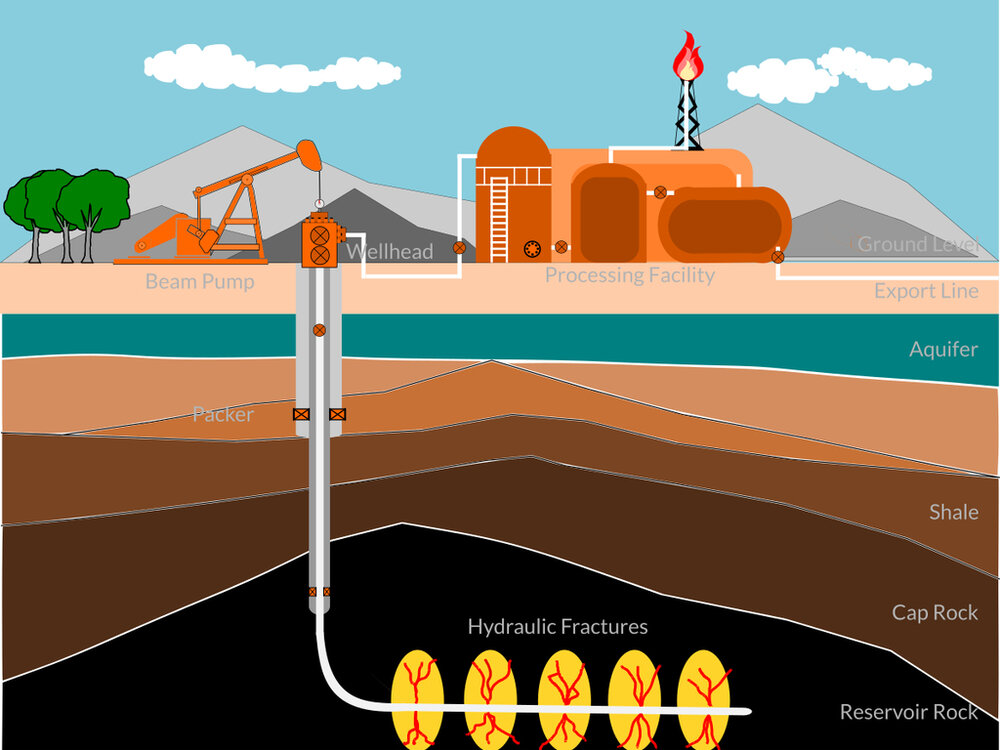

99% of wells drilled in the US today are horizontally drilled unconventional wells with a bunch of man-made propped hydraulic fractures. These fractures are created by pumping really hard against the reservoir rock with water (“hydraulic”), making a break (“fracture”) in the rock, then filling that fracture with sand to keep it open (“propped”). To transport the sand into the fractures, the sand is suspended in water and pumped down the pipe in a massive operation.

The bottom line is a LOT of water is pumped down into the reservoir in order to fracture a reservoir, typically 2-8 million gallons of water per well.

Water is heavier than oil and gas, something we’ve all seen when the salad dressing separates with the oil on top. A gallon of fresh water weighs about 8.3 lbs, while a gallon of gasoline weighs only 6 lbs (and a gallon natural gas is a mere fraction of that). When water is pushed down hole, the reservoir then has to push it back up before the oil or gas can follow behind it. Sometimes the reservoir just doesn’t have enough pressure to push the water up, and we need to give it some help.

The help is in the form of “artificial lift” (as opposed to the well flowing liquid to the surface by itself). This lift helps the liquid get from the bottom of the well to the top either by making the liquid not as heavy (gas lift, soap sticks), by pushing it up the well from the bottom (beam/rod pumps, electronic submersible pumps [ESPs], plunger lift), or by sucking it up the well from the top (wellhead compression, velocity strings). Typically, horizontally fractured wells use either gas lift or ESPs in the beginning if the well needs help getting the water out of the well.

OLDER WELLS & DEPLETED RESERVOIRS

Above: Image of a rod/beam pump well with production facility.

Dry gas wells (gas without much liquid in it, like Midland summer air rather than Houston humidity) usually can produce until abandonment without any lift help because gas is so light. Nearly everything else will eventually need help getting all the way from the reservoir to the surface.

Typically the artificial lift of choice for older wells is beam/rod pump or plunger lift because those methods are cheaper to run than ESPs or gas lift (although there are some creative uses of low-cost gas lift compressors these days) and the lower production rates of older wells don’t required the more expensive lift methods.

How wells are shut-in by operators

How a well is operated primarily depends on if SCADA (supervisory control and data acquisition) is installed or not.

Image from https://onping.net/features/

SCADA (sometimes called “automation”) is technology installed on the equipment at the well which lets operators remotely view production rates and pressures, turn engines on or off, open and close valves, and adjust parameters like pumping speed. It’s like Apple HomeKit or Alexa for the well. If a well has SCADA installed, the production can be stopped remotely (pumping unit turned off, a valve on the production line closed, etc.), as easily as a few clicks on a phone app. If the well is turned off for more than a few days or if the well has a significant amount of liquids on site in tanks, the operator may also send a technician (or “pumper” or “operator”) out to run through a checklist for securing the well long-term (flushing lines, having liquids hauled away, removing hazardous chemicals, etc.).

If the well does not have SCADA, the operator likely has a pumper going to each well once a day to read fluid rates and pressures and to check the location for leaks or damage (from vandalism, bad weather, cows scratching an itch…). Each pumper usually has 20-50 wells to check a day and can drive up to 400 miles to get the job done. Shutting in wells requires coordination between the office-based operating team and the pumpers to know which wells need to be stopped/closed and secured.

What happens once the well is shut in?

IMMEDIATELY

The moment the well goes from producing fluid to not producing, any liquid droplets or “slugs” that were making their way up the hole will fall back down and pressure will start to build in the wellbore. This pressure could slowly build 1 psi over 24 hours, or quickly with 1000 psi in a few minutes, all depending on the type of well and how much pressure is in the reservoir. If the well is an oil well with artificial lift, there will be a fluid level down in the well that represents the height the reservoir pressure can push the column of fluid up. Any water that was producing alongside the oil will settle to the bottom of the column of fluid, and any gas will bubble up into the open space above the fluid level.

1ST WEEK

After a week of being shut in, pressure will start building up downhole. This extra pressure typically brings extra liquids. If the well was brought back online now, the extra liquids in the wellbore could either temporarily bolster production, known as “flush production,” or it could damage production if the liquid is too heavy for the reservoir to push up the hold. Most decent wells can handle a week of shut-in without much (if any) consequence and return to prior production rates with ease, but it’s not guaranteed. The older the well, and the lower the gas rates, the more likely the well will struggle to return. Gas is a tremendous aid to the production of liquids (as discussed, water has the opposite effect).

Above: A workover rig on location

Wells with significant amounts of water or other corrosive fluids (CO2, H2S) may start to see enhanced corrosion damage downhole from the bacteria and acids starting to build as the fluids sit stagnant. Many operators will “workover” the well to remove downhole pumps, rods, and even tubing if determined the shut-in could be excessively long and damaging to equipment. Removing the equipment can cost between $5,000 and $50,000 depending on what’s downhole and what machinery is needed to remove it (workover rig vs. rigless, for example).

Engineers will be monitoring pressures at the wellhead (and sometimes downhole, if the well is fancy enough to have that technology installed) to determine if there are any surface or downhole leaks, and can also use pressure data to determine more characteristics of the reservoir, like remaining reserves.

60-DAYS

Above: A main street oil well in Barnsdall, Oklahoma USA

Many leases have language regarding how long the lease can go without producing before the lease is forfeited (though it can be more or less time depending on the lease). In layman’s terms, if a well is the only one in that lease producing and has a 60-day clause, on day 61 the operator loses the right to produce the well and only has the option to re-lease production rights from mineral owners, or plug & abandon the well. Sometimes there’s only a single mineral owner who is happy to work the operator to get the well back online, but other times there are 100’s of owners the operator would need to re-lease from (say, if there’s a subdivision of folks with mineral rights).

Sometimes there are also terms in leases requiring operators to pay shut-in fees. Further complicating things, a single well may have different lease terms with different mineral owners, and a field may have thousands of wells each with various leases. Just tracking the requirements for each and every well is a complex operation for Land departments, let alone coordinating these fees and risks in shut-in economics. Operators will sometimes try to skirt this issue and avoid triggering any shut-in fees or clauses by not fully shutting in the well, which they can do by either choking back production or allowing the well to periodically produce.

1-YEAR

After a year of being shut in, significant corrosion damage is likely to have occurred if the well has any water left downhole untreated. The state regulatory agency may have plugging requirements if a well remains inactive for certain time period, such as Texas RRC who requires an operator to remove 10% of inactive wells or more either by returning to production or by plugging (or pay a fee for a larger operator bond).

Source:

Source: